Off-Plan

Not, as one might think, anything to do with a plan going awry, but a kind of real estate investment.

Buying off the plan means buying a building, or a piece of a building, before it is built – even while it is no more than a plan.

But why would anyone want to do that?

Isn’t it risky?

Well, yes. For some buyers though, the risks are well worth it.

Non-Residents

Firstly, it is almost the only avenue open to purchasers who are not residents of Australia, but who want to buy residential property here. Non-residents need to apply for permission in advance of making a purchase of residential real estate. Provided the property has never been sold before, and no more than 50% of the investment is already owned by non-residents, permission will normally be given.

Secondly, not all developers are fly-by-night, and the big firms have good reputations.

Deposit Only Up-Front

Thirdly, a buyer only has to pay a deposit up-front. The balance is payable only when an occupation certificate is issued after completion. This allows a niche for the pure speculator who gambles that the property value will rise a little over the construction phase, allowing him to on-sell before completion for a profit potentially many times his investment in the deposit. This is brinksmanship, as values might well fall, leaving the property unsalable except at a loss. A loss that might also be a multiple of the original investment.

The delay in settlement not only provides sport for the reckless speculator in property values, it allows a normal buyer to save up for the purchase price, or at least a deposit to secure a mortgage.

Owners and Speculators

About half of buyers off the plan are eventual owner-occupiers, a quarter are investors, looking to take possession at completion and then rent out the property. The final quarter are the speculators. The majority of buyers therefore are in it for the long term – the only sensible approach to property investment – and wish to lock in their price at today’s levels and, if taxpayers, take advantage of a couple of small tax breaks available only to those who buy off the plan.

You aren’t limited to apartments either. Some of the best developments comprise house-and-land packages.

Risks

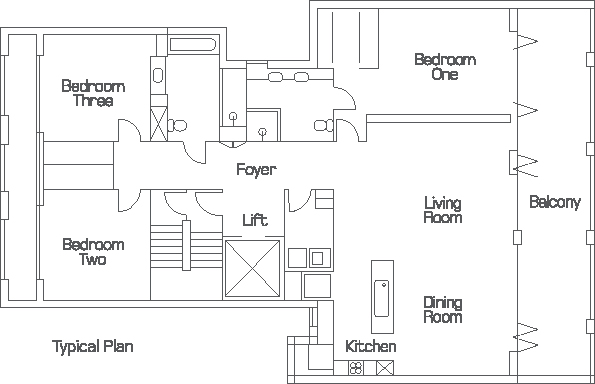

The risks involved are to do with the nature of the transaction: it is the purchase of a contract that contains a promise to build. You can’t see the property, or touch it, and many a purchaser has been disappointed when the built reality didn’t match the imagined ideal. It is important therefore to ensure that the property being bought is unequivocally described in the contract. If an apartment, on which floor? Facing in which direction? Of how many square metres of usable space? Unlike general property, strata title property measurements are from internal surface to internal surface – the true net measurement. Architectural drawings are measured to the middle of a wall, so the delivered space will be less than the original drawings implied.

The finishes must be described exactly, with samples provided, and any extras such as appliances that are part of the deal should be included in the wording of the contract.

Make sure everything is in writing

Just because something is displayed in the show flat, doesn’t mean it is automatically part of the deal. Make sure the show flat’s dimensions match the drawings of the flat you are being sold.

The developer making the promise to build is obviously worthy of hard-nosed research. What is their reputation? Look at some recently-completed projects. Look at re-sale values to ensure that they are keeping pace with market values. Make sure that the contract provides that your deposit is held in trust, and invested, so that if the project is delayed, or abandoned, the worst you will suffer is a loss of potential profit – apart from the property you’ve been waiting for. Make sure that if the property delivered is materially different from that agreed that you have a get-out clause.

Premium Prices

Finally, because of the restrictions on foreign ownership of residential property, beware the developments obviously designed to be attractive to non-residents. The limited supply creates a demand that can cause price premiums that can’t be sustained on re-sale to the domestic market.

Remember, do your homework, read the contract and don’t sign anything until your own solicitor says you should.